Pasangan mata wang EUR/USD cuba menunjukkan peningkatan yang ketara sepanjang hari lalu tetapi sebaliknya tidak menunjukkan penurunan yang kukuh. Secara rasmi, peniaga mempunyai alasan untuk membeli mata wang Eropah, tetapi sebenarnya, penghakiman ini sangat kabur. Pertama sekali, mari kita lihat gambaran teknikal. Euro masih terletak berhampiran garis moving average dan telah menghabiskan beberapa hari terakhir di flat langsung. Gambaran teknikal hampir sama dengan gambar untuk pound sterling. Kedua-dua mata wang Eropah didagangkan hampir sama sekarang, yang membolehkan kita membuat kesimpulan bahawa faktor yang dikaitkan dengan dolar AS dan Amerika Syarikat mengatasi semua yang lain. Mata wang Eropah, serta pound, cuba meneruskan pergerakan menaik dan juga tidak tahu mengapa melakukannya. Pembetulan teknikal, jika ia belum berakhir, tidak boleh menolak pasangan itu ke atas untuk masa yang lama. Ingat bahawa kebanyakan faktor geopolitik dan asas terus bekerja berbanding euro dan dolar AS.

Oleh itu, kami percaya bahawa masih terlalu awal untuk bercakap tentang penghujung arah aliran menurun jangka panjang. Pasangan itu telah berhenti selangkah dari paras terendah 20 tahun, tetapi ini tidak bermakna ia tidak akan meneruskan kejatuhan dalam seminggu atau sebulan. Ingat bahawa Fed harus menaikkan kadar utama pada bulan Jun dan Julai, dan isu ini telah diselesaikan dan ditutup secara praktikal. Kami telah pun menerangkan mekanisme yang membolehkan dolar AS terus meningkat dalam harga disebabkan oleh kenaikkan kadar Fed. Ringkasnya, semakin tinggi kadar Fed, semakin menarik ekonomi Amerika dan perbendaharaan Amerika. Dan bon Perbendaharaan dan pelaburan dalam ekonomi AS tidak boleh dibuat dalam euro. Ia adalah perlu untuk membeli dolar AS, oleh itu, permintaan untuk mata wang AS mungkin terus berkembang. Ingat juga bahawa laporan COT selama beberapa bulan berturut-turut menunjukkan mood "menaik" pemain utama, tetapi euro kebanyakannya jatuh. Ini hanya boleh berlaku jika permintaan terhadap dolar AS lebih tinggi dan berkembang.

ECB telah berjanji untuk menaikkan kadar pada musim panas dan musim luruh.

Sementara itu, pedagang menunggu pengumuman keputusan mesyuarat ECB. Tiada seorang pun daripada mereka menjangkakan bahawa kadar akan dinaikkan pada bulan Jun. Maksimum – penyiapan program rangsangan ekonomi APP akan diumumkan. Pada hakikatnya, bank pusat EU telah membuat kenyataan bahawa kadar utama akan meningkat sebanyak 0.25% pada bulan Julai dan sekali lagi (juga, kemungkinan besar, sebanyak 0.25%) pada bulan September. Oleh itu, kadar margin mungkin bergerak ke julat 0.5-0.75%, tetapi apakah yang ia berikan? Adakah langkah sedemikian dapat memadamkan inflasi di Kesatuan Eropah jika minyak semakin mahal hampir setiap hari, dan Ukraine disekat daripada eksport bijirin? Intinya ialah ECB hanya boleh menaikkan kadar beberapa kali, dan Fed akan menaikkannya sehingga inflasi kembali kepada sasaran 2%. Ini adalah perbezaan utama antara dasar monetari ECB dan Fed.

Sudah tentu, ECB boleh mengubah retoriknya "semasa permainan." Awal tahun ini, Christine Lagarde membandingkan ekonomi Eropah dengan "orang kurang upaya bertongkat" dan berkata bahawa tidak akan ada kenaikan kadar pada 2022. Kini keadaan berubah. Oleh itu, ia juga mungkin mengubah musim gugur ini. Tetapi pada masa itu, kadar Fed sudah pun meningkat kepada 2-2.5%, iaitu mata wang AS masih mempunyai kelebihan berbanding euro. Oleh itu, secara rasmi, mata wang Eropah mempunyai peluang untuk meneruskan pertumbuhannya pada minggu-minggu akan datang, kerana pengawal selia Eropah telah mengetatkan retoriknya. Tetapi kami mengingatkan anda bahawa kedua-dua pasangan utama kini lebih melihat kepada dolar, Amerika Syarikat dan Fed. Dan katakan pada TF 24 jam, adalah jelas bahawa sepanjang tahun lalu, pembetulan maksimum pasangan itu ialah 400 mata yang tidak realistik. Kini mata wang Eropah telah beralih daripada paras terendah baru-baru ini sebanyak 450. Dan bulan ini, akan ada mesyuarat Fed, di mana kadarnya dijamin akan dinaikkan sebanyak 0.5%.

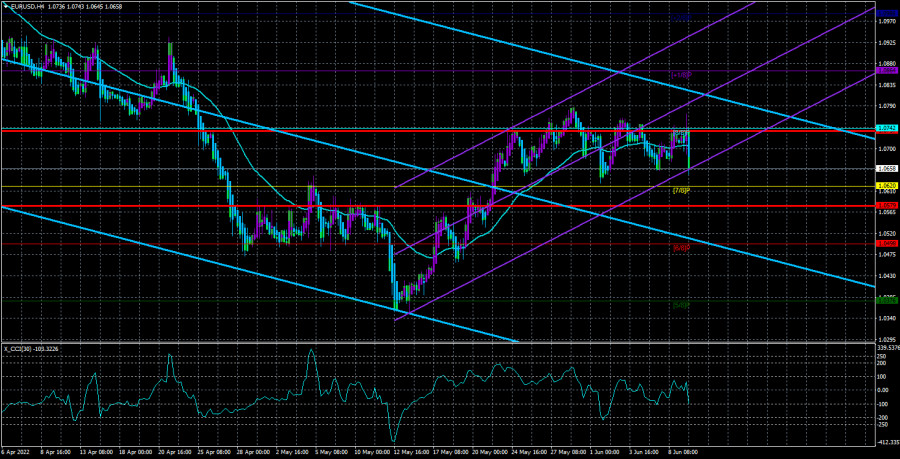

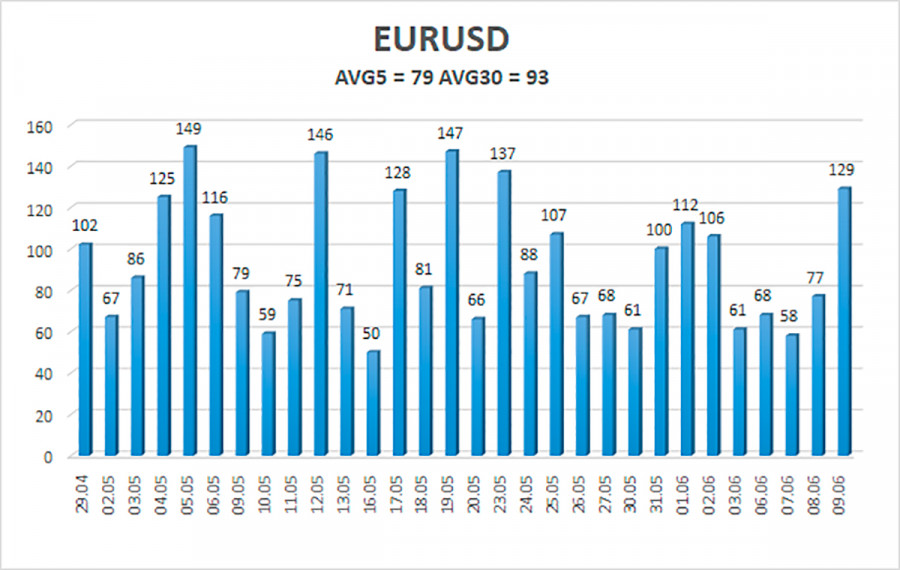

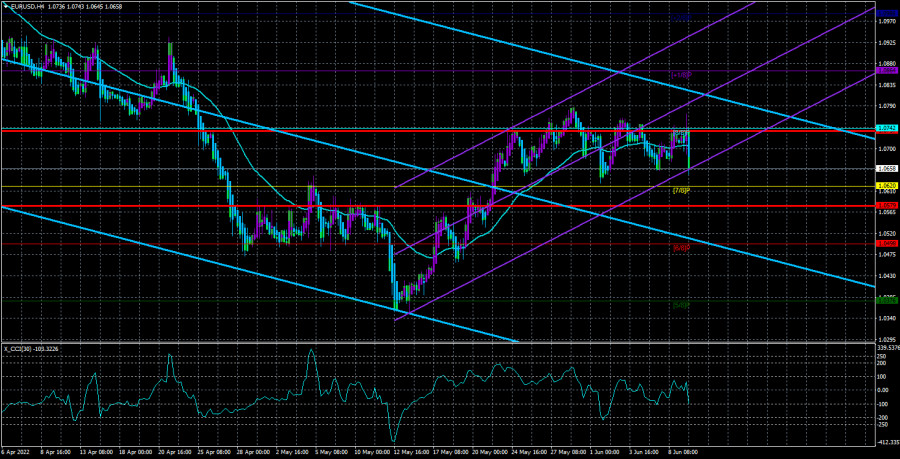

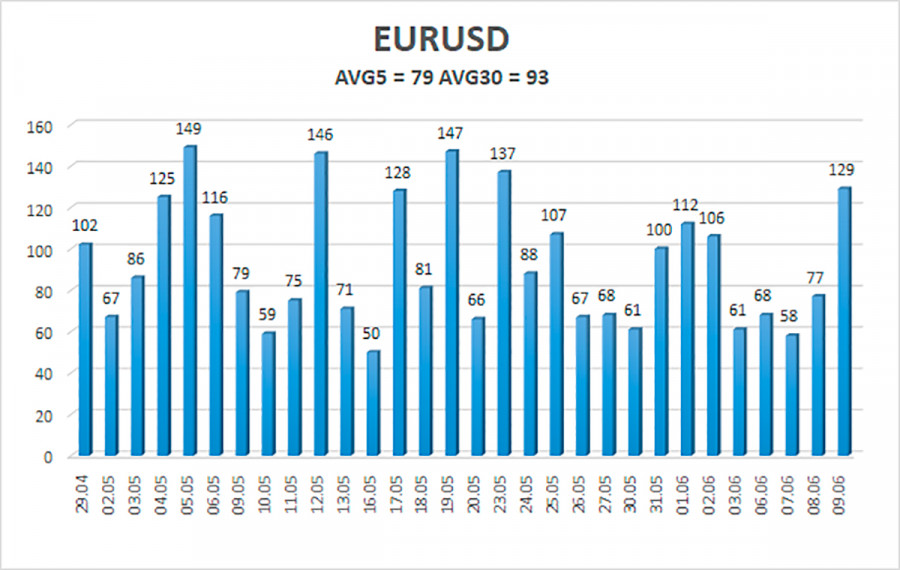

Purata volatiliti pasangan mata wang euro/dolar AS sepanjang 5 hari dagangan terakhir pada 10 Jun ialah 79 mata dan dicirikan sebagai "purata". Oleh itu, kami menjangkakan pasangan itu akan bergerak hari ini antara tahap 1.0579 dan 1.0737. Pembalikan indikator Heiken Ashi ke atas akan menandakan pusingan baharu pergerakan menaik.

Tahap sokongan terdekat:

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Tahap rintangan terdekat:

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Cadangan dagangan:

Pasangan mata wang EUR/USD telah disatukan kembali di bawah moving average dan sekali lagi cuba untuk melaraskan ke bawah. Oleh itu, kini adalah mungkin untuk kekal dalam posisi dagangan menjual dengan sasaran 1.0620 dan 1.0579 sehingga indikator Heiken Ashi muncul. Posisi dagangan membeli harus dibuka dengan sasaran 1.0864 jika harga ditetapkan di atas tahap 1.0742. Pada masa ini, terdapat kebarangkalian tinggi untuk "ayunan" dan rata.

Penjelasan ilustrasi:

Saluran regresi linear - membantu menentukan arah aliran semasa. Jika kedua-duanya diarahkan ke arah yang sama, maka trend itu kukuh sekarang.

Garis moving average (tetapan 20.0, terlicin) - menentukan arah aliran jangka pendek dan arah yang anda patut berdagang sekarang.

Tahap Murray - tahap sasaran untuk pergerakan dan pembetulan.

Tahap volatiliti (garisan merah) - saluran harga yang berkemungkinan di mana pasangan itu akan berbelanja pada hari berikutnya, berdasarkan indikator volatiliti semasa.

Indikator CCI - kemasukannya ke dalam kawasan terlebih jual (di bawah -250) atau ke dalam kawasan terlebih beli (di atas +250) bermakna pembalikan arah aliran dalam arah bertentangan semakin menghampiri.